Legal minimum for online shops in seven points

1. Identification of the Entrepreneur

The basic data about the company normally include the name of the entity, form of business, address, ID number (alt. VAT number), the place of registration in the commercial register and the name of the managing director (or statutory representative). According to the latest guidelines, a telephone number and e-mail are also mandatory. It is not sufficient to include the information only in the GTC or the Claims Procedure, but it must be easily traceable. Fines for non-compliance with this rule are common, so place them in a prominent place, such as the footer of your online shop.

2. Terms & Conditions

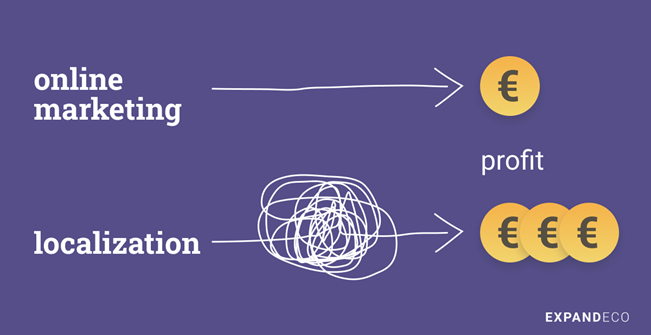

The prerequisite for the drafting of the GTC is the selection of the legal entity, the country of business (or the laws of which country the entity will be governed by) and the choice of language. Beware, however, this is language that the consumer must understand, which can be misleading and objectionable. For example, if English is spoken in Denmark, it might be English. However, in order to ensure the good localization and credibility of the online shop, we recommend translating the website into the official language of the country where the online shop is expanding.

Clear wording with clear instructions to consumers about their rights is a must for GTC. They must be placed on a durable medium or be drawn up in paper form. The consumer has the right to have access to the specific terms and conditions at the time he or she concluded the sales contract. The ideal and bulletproof system is to attach a PDF to the email you send to the customer with the order confirmation. The date-stamped versions of the GTC are also a frequently used form. There is also a so-called "button amendment" that is valid, which defines that by pressing the "ORDER" button the customer commits to payment.

"Law firms dedicated to e-commerce law, such as Legitas, will draw up elaborate GTCs for you, but the law does not allow them to take full responsibility for them in another country." - Petra Stupková, Legitas

It is therefore highly recommended that you consult a local attorney who can take responsibility for your actions.

Claims and withdrawal from a contract are also a fixed part of the terms and conditions. They need to be distinguished in the terms and conditions because they are subject to different legal consequences.

a) Withdrawal from a contract

Withdrawal periods are subject to local laws, so you are obliged to adapt them. Their extension in competition is no exception. The question is whether you decide to adapt the deadline to each country or implement it for each country. A withdrawal form template is included in the EU Directives. Its wording must also clearly instruct the consumer (withdrawal period, refund of the cheapest postage, forms of return, etc.). The contract cannot be withdrawn if the goods are customized or for hygiene reasons. This also applies to accommodation, transport or perishable goods.

b) Claims Policy

The EU trend is to extend the deadline for complaintsto eliminate consumerist behavior. It is an indirect incentive for producers to produce better quality goods. However, each country adjusts the time limit according to local laws. It usually ranges from 12 to 24 months. If the sold item, its packaging or the attached instructions have a period of use marked on them, the warranty period does not expire before the expiry of this period.

While the warranty period has a clear time limit, the deadline for processing a claim is not commonly regulated across the EU (most often around 4 weeks). In some countries it is not even time-limited (for example in Austria). So we recommend that you check and include the country's deadlines directly in your documents.

Example of a correct indication of a claim and return of goods:

3. Collection of Personal Data

GDPR, standing for "General Data Protection Regulation" is an EU regulation dealing with the processing, protection and storage of personal data. Did you know that data protection is a fundamental human right? The user must be clearly informed about which data you are collecting, for what purpose and must consent to the collection. Most online shops declare this with checkboxes and links to the full text of the terms and conditions. Data must be securely stored and traceable. It is also the obligation of the online shop operator to collect the correct data, which should be verified, most often for example through email identity verification.

Cookies are also included in the package of personal data. They are a form of personal data that outwardly ensure the comfortable use of the website, but are also subject to legislation. So they must be clearly defined with the possibility of selecting individual points and agree on their collection. Always use a mechanism where your consent can be withdrawn.

TIP: Beware of "word games" and ill-defined consents/lack of consents that are legally actionable. Definitions must be clear and not mislead the consumer.

Example of indicating consent:

4. Trademark

Remain original, protect your brand, prevent misuse. Before expanding, look at your competition, look for similar brands or even the same ones. Register your domains, secure your trademarks. This will prevent potential problems.

5. Legal Form of Business

Most commonly used forms: sole proprietorship, limited liability company, joint stock company, European company – also known as SE (Societas Europea).

It is up to your discretion, method and scale of business what form you choose. In any case, it is necessary to pause over the individual clauses that could undermine the expansion itself. Look at the legal implications of entering a new market, pre-emption rights, shareholder relations and crisis resolution options.

Establishing a local entity is also an option. This will grant your business more credibility and a better working relationship with your employees. On the other hand, it also means more administration, a higher tax burden and higher costs.

6. VAT and One Stop Shop (OSS)

The legal form of business is directly linked to the obligation to pay taxes. The EU has introduced a special tax arrangement, the OSS, to standardize the procedure for each Member State. The OSS is a one-stop scheme and is used for the payment of VAT right at the place of registration. It only applies to B2C (business-to-customer) transactions where the customer is a non-taxable person, i.e. the end customer. A new uniform limit of €10,000 excluding VAT was introduced from 1 July 2021. The use of a single point of contact is not mandatory. However, it significantly simplifies the payment of VAT by users to be applied in another EU country.

7. Commercial Content Creation

A less discussed but equally important topic is the legal-commercial scope. This is an area where mistakes are frequent, which also means a drain on finances.

Any advertising campaign must not be offensive, discriminatory, intimidating, disparaging of competitors or derisive. It must not be plagiarized and must have clearly established copyright (graphics, music, photos, videos). These are all legally actionable forms that are routinely fined. Also watch out for sensitive content, children's products, alcohol, weapons or tobacco products. Even if you make use of seemingly freely available online content, their licenses are often restricted. By downloading photos from the official photo library, you do not automatically obtain the consent of third parties.

At the same time, influencer marketing and the use of freelancers and IT developers is a popular form. Any such collaboration should be legally and contractually defined, have clearly defined terms and conditions, defined licenses, SLAs*, remuneration. Don't forget about GDPR and data storage for competitions. The issue is also linked to unfair business practices with unlabelled advertising, an untraceable source of reviews, double quality of products or promotion of products for which the customer has not given you consent. Promotion is only possible for your own or similar products.

* service level agreement