What happened, didn’t happen and how we did in 2024

I'm back with another "annual" blog, which was supposed to be shorter, but my brother-in-law and co-owner of Expandeco, Mirko Kráľ, gave me feedback: “Please add your perspective on the market in 2024 – I’ve gotten feedback that people enjoy reading it and find it interesting.”

So, I decided to elaborate a bit. Hopefully, you’ll forgive me. A lot has happened, and I’m wondering where to begin to encapsulate the extraordinary year 2024 for us.

Firstly, the promised POV on the e-commerce in 2024 a.k.a. RIP to everyone who believes in resell

After 2023, which was likely the toughest year for SK/CZ e-commerce in the past decade, I consider 2024 to be a rebound year. It’s impossible to generalize, but we have detailed insights into hundreds of Czech and Slovak e-commerce businesses.

They year of 2024 wasn’t significantly better than the previous year. However, it was evident that e-shop owners planned investments more prudently, monitored costs, and optimized wherever possible. From the "no-growth" situation of 2023, we estimated a qualified growth rate of around 5–10%.

Big players like Temu, Trendyol, Shein, and Allegro were still a topic of discussion in 2024. Their activity and presence undoubtedly contributed to significantly increasing advertising costs in many categories, sometimes by tens of percent.

By the way, while we’re all focusing on large foreign players, Alza continues to quietly excel. Temu likely had its momentum already, but I believe Trendyol and Shein will grow significantly in our region, and Allegro might finally start establishing itself here in 2025.

Anyways…

We all know this presents a massive challenge for e-commerce players. The market is evolving, with not only global but also strong regional players (e.g., from Poland) entering our region, and brands increasingly moving towards D2C.

I’m skeptical about, or rather, no longer I believe in the classic business model of manufacturer-wholesaler/distributor-B2C. "Per unit economics" simply doesn’t allow it.

Put simply, it’s the time to consider where (China, Bangladesh, Turkey, India, Pakistan, Vietnam, Poland?) and with which partner you can innovate and bring new products to market under your own brand. Without this, it’s likely only a matter of time before your business starts declining.

Reselling might still work for brands like Footshop, which excellently combine classic retail with e-commerce, build strong communities around brands, and showcase delivered brands at a world-class level. That adds immense value and explains why global brands are willing to collaborate long-term and even support them with marketing and budgets.

If you don’t dare to venture into your own product journey, think like Footshop—be an attractive partner for your suppliers who goes the “extra mile” even when presenting other brands.

Despite the challenges mentioned above, we predict e-commerce growth will continue at a pace similar to 2024…

What Did We Work On at Expandeco?

From the goals we set (mentioned in the 2023 Recap article), we managed to achieve most of them:

- We attended numerous e-commerce events across Europe – in Bratislava, Berlin, Budapest, Prague, Warsaw, London, Vilnius, and Zagreb.

- We launched an online returns form for e-shops. It’s currently live with our first clients, and we plan to fully launch it in 2025.

- We processed over 170,000 returns from across Europe. While e-shops would prefer fewer returns, our goal is to optimize the returns process, which increases customer satisfaction for our clients.

- We succeeded in hiring, which I’m thrilled about. Our team welcomed Janka Reberšak as B2B Partnership Manager, operating from Prague. Thanks to her efforts, we significantly improved partnerships that we had previously neglected, enhancing our business strategy and strengthening our Czech team.

- We made significant progress in Poland, stabilizing our team and achieving growth. This sets us up well for the future.

- Expansion into Germany was a mixed success. We participated in an exhibition in Berlin in Q1, acquired a few clients, and initiated some activities targeting the German market. However, we lacked the time and energy to fully commit, so this goal shifts to 2025.

- Last, but not least, we considered bringing in a strategic investor for the company. 👇

BIG GAME a.k.a. Acquisition of a Logistics Company and Welcoming Investors

One of our major projects this year was the vision to build a comprehensive platform for e-commerce expansion. This included the long-planned acquisition of a Czech logistics company, Pošta bez hranic, perfectly aligned with our vision. By the time this article is published, it should be clear who we’re talking about.

This acquisition allows Expandeco to finally offer cross-border logistics services, a highly demanded feature from both existing clients and virtually every new leads.

This is great news for us and our clients. By merging the infrastructure of two established companies, we create numerous synergies that will benefit both current and new clients. I’ll write more about this deal in the future…

For now, I want to extend my heartfelt thanks to the investment platform Crowdberry and more than 150 investors from Slovakia and the Czech Republic who decided to support us in our vision.

We’re excited about the trust shown by the investment market. Among our investors are many of our acquaintances, friends, clients, business partners, and prominent entrepreneurial figures, not only from the e-commerce sector. This is a significant honor and, above all, a responsibility.

Once again, I assure you that my team and I will do our utmost for our shared success!

A Few Numbers from Expandeco’s backstage

I’ll keep it brief this time:

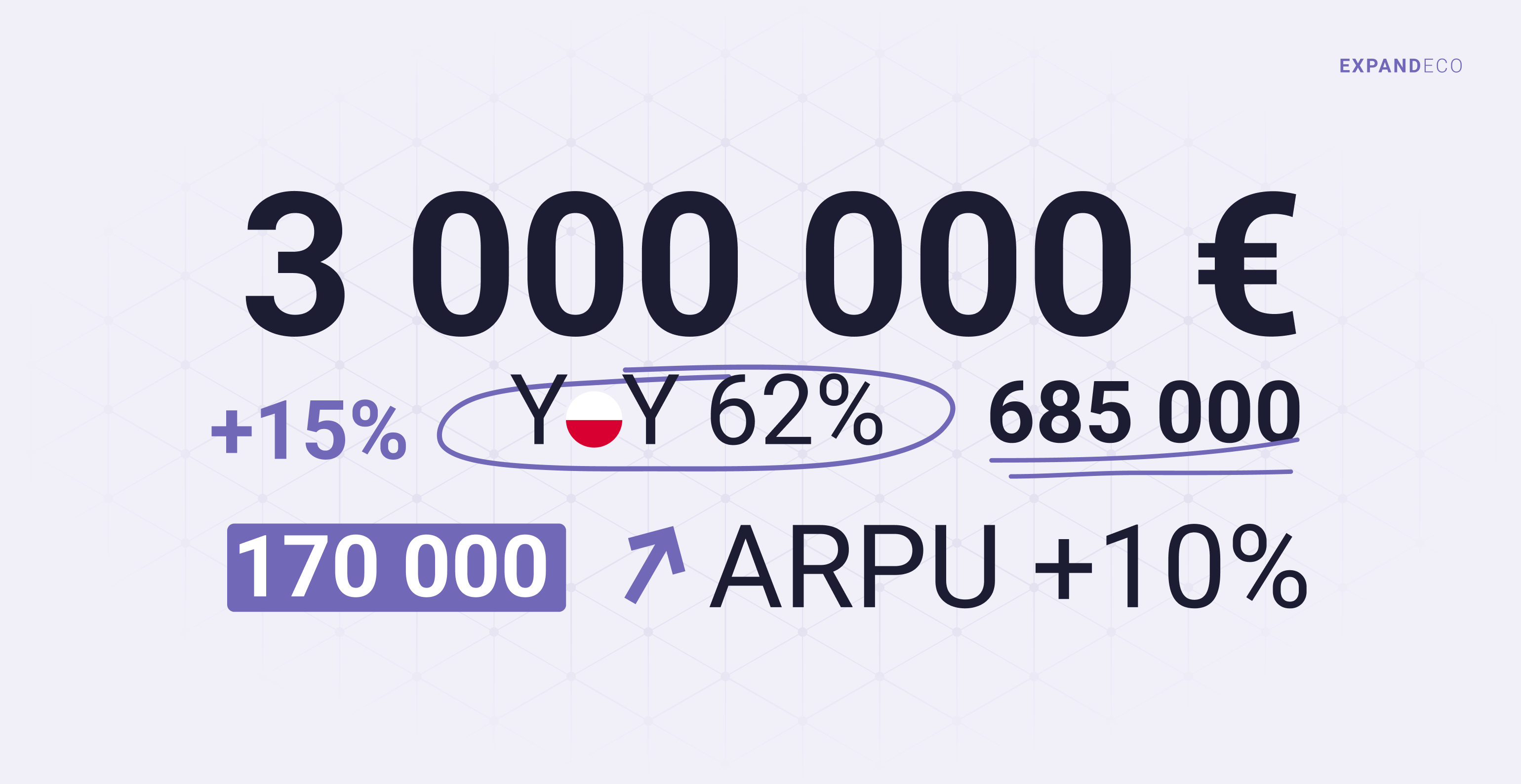

- We surpassed €3 million in revenue,

- Achieving approximately 15% year-on-year growth.

- We grew in Poland by 62% YoY.

- We increased ARPU by 10%.

- We handled over 685,000 tickets.

- We processed more than 170,000 returns.

And What About 2025?

Our absolute priority is successfully managing the acquisition and merging of the two companies. There’s a lot of work ahead, not only in maximizing synergies, but the initial outlook is very promising and encouraging. Our joint revenue target is €20 million.

I know I can rely on my excellent colleagues at every level. I must, and want to, especially thank them and our loyal customers. Thanks to the dedication of my colleagues and the long-standing trust of our partners, we’ve had another successful year.

I wish the entire e-commerce scene a prosperous and fulfilling year in 2025—both in business and in life.